2

0

4

6

8

10

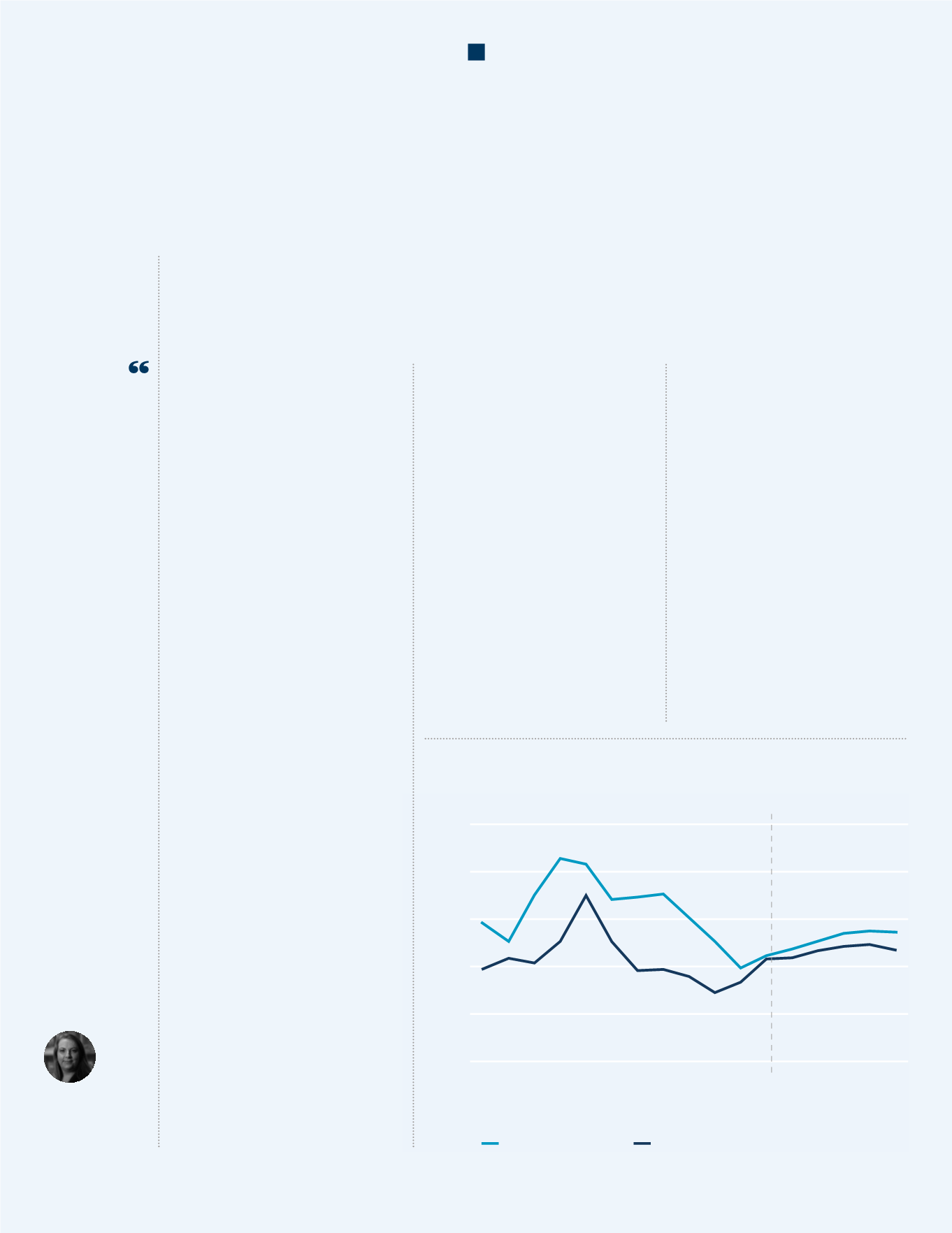

2021 Q4

2020 Q4

2019 Q4

2018 Q4

2017 Q4

2016 Q4

2015 Q4

2014 Q4

2013 Q4

2012 Q4

2011 Q4

2010 Q4

2009 Q4

2008 Q4

2007 Q4

2006 Q4

Vacancy Rate (%)

City Vacancy Rate

West End Vacancy Rate

Supply levels have increased across

the capital during 2017, to reach

13.5 million sq ft at the end of

April. This increase (16%) was to

be expected due to the pipeline of

new developments approaching

completion, (a total of 1.9 million

sq ft is now within 6 months of

completion - but this also reflects

the geographical expansion of

Central London to include White

City). Nevertheless, high levels of

pre-let space (around 48% of space

completed in the 18 months to 2017

Q3) has helped to alleviate the

impact of new completions.

The volume of speculative space

under construction contracted

quarter on quarter by around

700,000 sq ft and the speculative

pipeline remains relatively

constrained into 2018. Eight million

sq ft of completions are expected

in 2017, but the majority of this is

already included in supply data and

therefore its impact has already

been felt. 2018 could see up to 8.5

million sq ft delivered, albeit at this

stage only 6.3 million sq ft is under

construction. Currently, 61% of space

already under construction has been

pre-let or is under offer, leaving just

2.4 million sq ft of speculative space

under construction. This suggests

that there is potential for the recent

upswing in supply to be reversed

in the short term, even allowing for

an increase in second hand space.

Beyond 2018, there is scope for an

upswing in development completions

but much will depend upon the

confidence of developers and

available funding in these uncertain

political and economic times.

We have already seen an uplift in

sublet space across Central London

with 3.1 million sq ft available at

the end of Q1 compared with 2.1

million sq ft during the same period

last year. Much of this sublet space

was as a direct result of changes in

business strategies and M&A activity,

By Hayley

Armstrong,

Research Analyst,

London Markets

Rising Supply –

a Threat to theMarket?

Beyond

2018, there is

scope for an

upswing in

development

completions

Central London Vacancy Rates

for example, rather than as a direct

result of the vote to leave the EU, we

estimate that sublet space currently

accounts for 24% of supply; which

while seemingly high, is virtually on

a par with the average proportion

since 2009 (and only falling back

to volumes recorded as recently

as 2015).

There is likely to be further

tenant-sublet space brought to the

market as occupiers reassess their

holdings in relation to the changing

business environment. However, we

also anticipate a proportion to be

taken up by cost sensitive tenants

who continue to pursue value or

seek short-term overflow space. It is

useful to note that over half (54%)

of the sublet space currently on

the market is available for a term of

less than five years and in absolute

terms this is at a similar level to the

volume of short term space that has

been let over the last 12 months.

Sublease space has a part to play

in the market. This is certainly true

as economic uncertainty, coupled

with the cost of relocating and the

relatively limited choice particularly

for larger companies, has supported

the trend for overflow space rather

than committing to a full-scale

move. To date in 2017, 16% of leasing

volumes have been for sublease

space, of which two thirds, by both

volume and number, have been for a

term of less than 5 years.

Looking forward, the market

appears relatively insulated from

any significant supply side shocks

with limited volumes of speculative

development due online over the

next 18 months and some schemes

pushed back, but not cancelled. As

a result, although we expect supply

to trend upwards, it will be at a

relatively benign rate.

CUSHMAN & WAKEFIELD

24

LONDON IN FIGURES