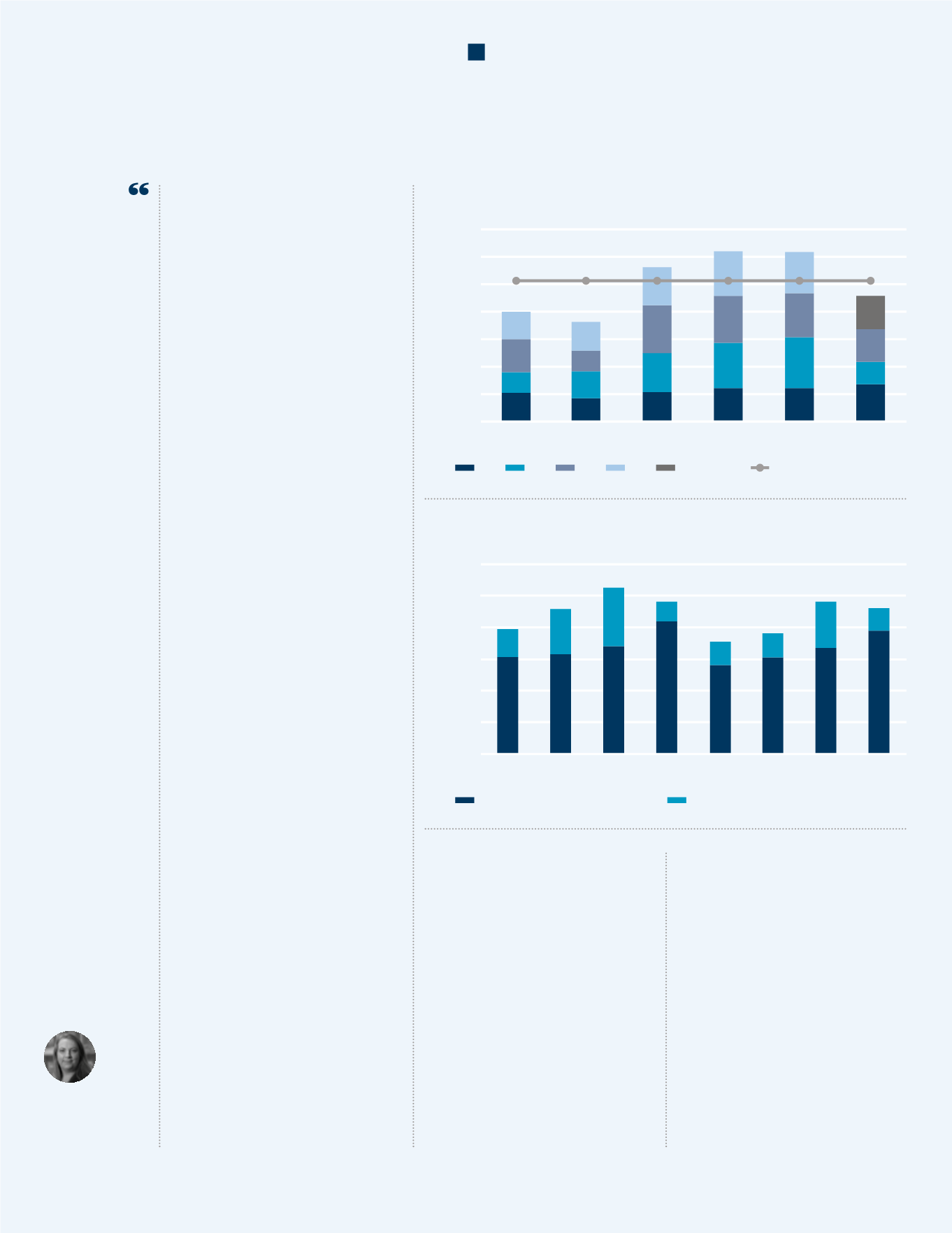

The vote to leave the EU coincided

with the summer lull and as a result

inertia was the underlying trend in

the leasing market. Nevertheless, the

market received a shot in the arm

in Q3 2016, with Apple committing

to c.500,000 sq ft in Battersea.

As a result central London leasing

volumes were up 22% quarter on

quarter. Q3 take-up volumes reached

2.4 million sq ft, up from 1.6 million

sq ft in Q2 2016, which took the year

to date figure to 6.7 million sq ft.

Leasing deals that were underway

in the run up to the EU referendum

are progressing, albeit slowly and

there are few signs that occupiers

have aborted deals as a result of the

vote. Almost 60% of deals under

offer pre-referendum have now

signed, with a further 19% under

offer and progressing, although

some with greater incentives for

the tenants. Just 21% are on hold or

are not proceeding, but this is not

necessarily a direct result of the vote.

The test to come will be with the

level of new space commitments that

will transact in the future. The rate

of space going under offer slowed

markedly in the aftermath of the

referendum. In the 12 months prior

to the vote, on average 2.1 million sq

ft of new commitments went under

offer each quarter but this dropped

to 1.5 million sq ft in the three

months since the vote. While July

and August were quiet, as occupiers

took stock, there was a flurry of

activity in September when almost

727,000 sq ft of space went under

offer, including five transactions over

50,000 sq ft and some substantial

prelets. As a result space under offer

was back to that recorded in June

2016. One must bear in mind that

these figures are being supported by

the length of time that transactions

are taking to translate from going

under offer to a signed deal.

But the scale of space under offer

at the end of September has shown

London’s occupiers are ready to

move forward when confronted by

the realisation that Brexit will not be

a quick process. The commitment

by Wells Fargo to a new office at

33 Central along with Google’s

announcement that they will push

ahead with their headquarters at

King’s Cross, creating up to 3,000

new jobs are significant illustrations

of this.

This does not disguise the fact

that uncertainty still prevails and

occupiers are reviewing their

property strategies, seeking better

terms or extending their leases in the

short term to allow them to assess a

post-Brexit London. In this respect,

2017 could be a challenging year for

the leasing market but ultimately

central London should remain

resilient and continue to be attractive

to businesses around the world.

By Hayley

Armstrong,

Research Analyst,

London Markets

Post-

Brexit

Leasing

Market

14.0

12.0

10.0

8.0

6.0

4.0

2.0

0.0

2011

2012

2013

2014

2015

2016

sq ft (millions)

Q1

Q2

Q3 Q4 Under offer

5-year annual average

1.0

1.5

2.0

3.0

2.5

0.5

0.0

Oct 16

Sep 16

Aug 16

Jul 16

Jun 16

May 16

Mar 16 Apr 16

sq ft (millions)

Total under offer less new

New under offer

The test to

come will be

with the level

of new space

commitments

that will

transact in

the future

Central London Leasing Volumes

Central London Under Offer Trends

CUSHMAN & WAKEFIELD

26

LONDON IN FIGURES