Central London leasing activity

continues to surprise with quarter on

quarter uplifts and above average

volumes recorded across the capital.

While aggregated figures tell one

story, the underlying data provides a

different narrative.

Confounding post referendum

expectations, the number of

transactions in 2017 above 100,000

sq ft is 20% above the 5-year average,

with 11 transactions above that

threshold in the year to date. This

demonstrates the continued attraction

of London post Brexit and occupier

confidence to make wholesale moves

and consolidations. The pre-let market

accounts for 68% of the deals above

100,000 sq ft in the last five years,

and 73% of 100,000 sq ft+ deals in

2017 so far. This suggests long term

commitment to London from a diverse

occupier base.

A number of high-profile leasing

transactions, such as Deutsche Bank

at 21 Moorfields (469,000 sq ft),

WeWork at Two Southbank Place

(283,000 sq ft) and Boston Consulting

Group at 80 Charlotte Street (124,000

sq ft), are making headlines but it

is important to remember that the

smaller occupier market has always

supported activity levels.

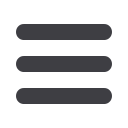

Both the 10,000-25,000 sq ft and

25,000-50,000 sq ft brackets have

seen an upturn in activity during

2017, with above average numbers

across Central London particularly

for transactions above 25,000 sq ft.

The area of concern is the

reported thinning of the bottom end

of the market, especially transactions

of 5,000-10,000 sq ft. The number

of transactions recorded this year in

this size band was down 11% against

the 5-year Q1-3 average while as

a percentage of the total number

of transactions, there has been a

gradual downward trend over the

last five years. There is a perception

that this ‘hollowing out’ would be

more prevalent in the West End

market, but the data confirms the

opposite; there were 80 transactions

of 5,000-10,000 sq ft in Q1-3 2017,

which is directly in line with the

5-year average for the West End.

By Christopher

Dunn,

Senior

Insight Analyst

Size Band

Analysis

Persistent

growth from

the office as a

service sector

surely raises

the potential

for further

pressure on

the smaller

end of the

market

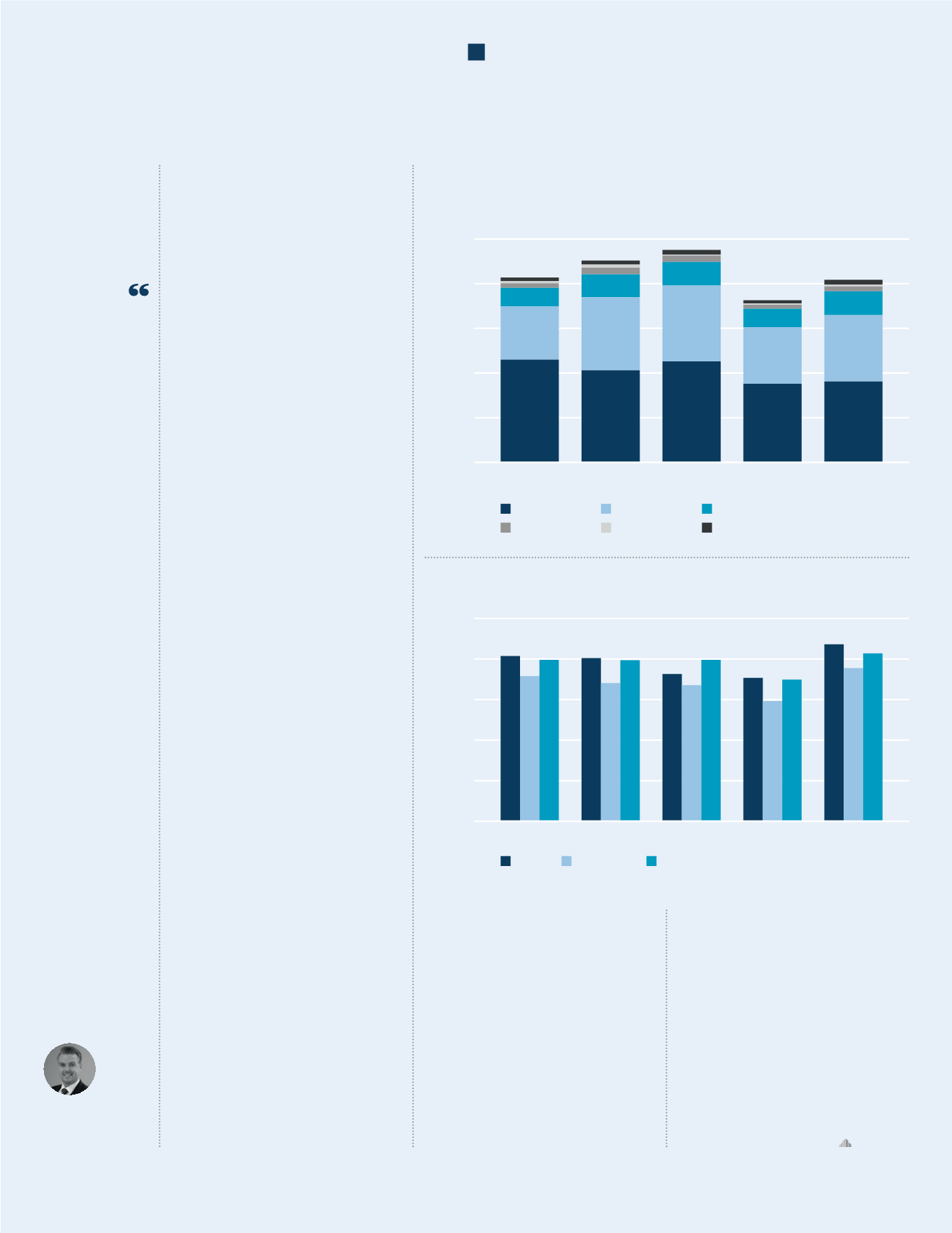

Average Transaction Size by Market (sq ft)

Central London Transactions by Size Band for Q1-3

(over 5,000 sq ft)

Because of these size shifts, the

average transaction size in Q1-3 2017

was 20,620 sq ft, some 4% higher

than the 5-year average deal size

(19,807 sq ft).

The above analysis concentrates

on all transactions above 5,000

sq ft. Whilst there have been 409

leasing transactions above 5,000

sq ft in 2017 YTD, there have been

928 below that threshold in the

same time period. The sub-5,000

sq ft market in Central London

accounts for 69% of transactions

(by number) but only 19.8% by

volume. The number of these small

transactions is also down year on

year, supporting the two-tier market

being observed between large and

small transactions.

It is potentially too early to

make any concrete conclusions

about whether this shift in deal

size distribution will continue, but

persistent growth from the office

as a service sector surely raises the

potential for further pressure on the

smaller end of the market. There is

of course continued political and

economic uncertainty, which could

impact the frequency of larger

transactions in the future.

0

100

200

300

400

500

5,000-9,999

Number of CL Transactions

2013 Q1-3

2014 Q1-3

2015 Q1-3

2016 Q1-3

2017 Q1-3

10,000-24,999

25,000-49,999

100,000+

50,000-74,999

75,000-99,999

0

5,000

10,000

15,000

20,000

25,000

City

2013

2014

2015

2016

2017

West End

Central London

CUSHMAN & WAKEFIELD

26

LONDON IN FIGURES