In North London, Hammerson Plc

and Standard Life Investments have

revealed plans this quarter for a

£1.4 billion (1 million sq ft) retail and

leisure extension to Brent Cross

London. In Croydon to the south,

Hammerson Plc and Westfield have

recently submitted an enhanced

proposal to deliver another £1.4 billion

development (1.5 million sq ft) of retail

and leisure. In the west, Westfield

are pursuing a £1 billion extension to

Westfield London that will provide

an additional 740,000 sq ft of space.

And in the east, Westfield’s Stratford

City goes from strength to strength

with 42 million footfall in 2015 and

significant rental growth.

This £3.8 billion pipeline will

ensure each quadrant of London

has the benefit of a world class

shopping and leisure hub to support

a population that the Mayor expects

to reach 10.89 million by 2041. The

remaining challenge for developers is

how to future-proof these schemes

against continual technological

advancements and disruptions.

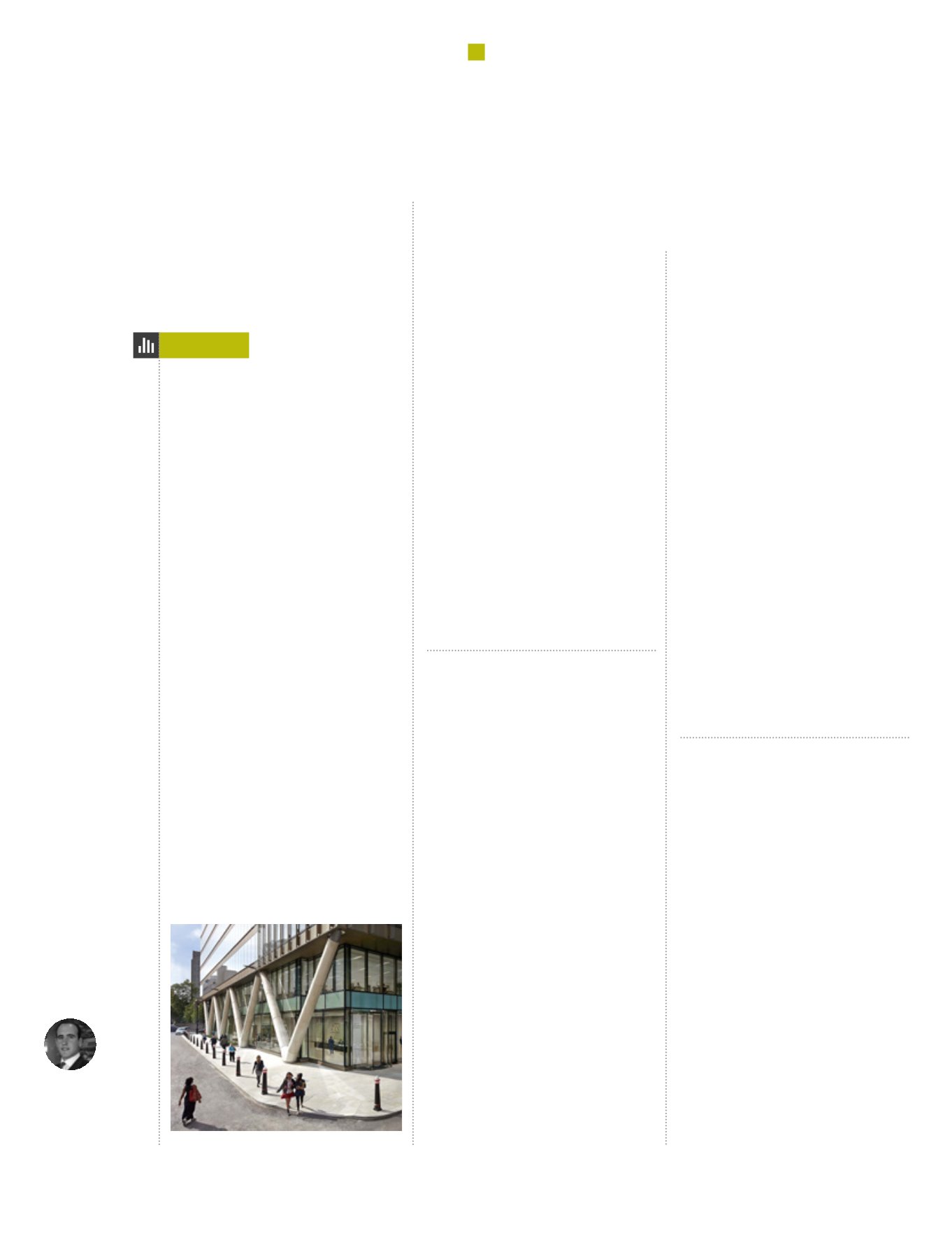

Hong Kong investor Kingboard has

bought the freehold interest in Moor

Place, EC2, for £271 million reflecting

a NIY of 4.86% and a capital value of

£1,144 per sq ft. The 236,793 sq ft City

office building is the European HQ of

WeWork, with 73% of the space let to

the co-working behemoth until 2035.

This is only the second time

WeWork’s covenant has traded and

the first of this scale. This follows

Corpus Sireo’s purchase of a 10%

geared leasehold interest in 33 Queen

Street, EC2 where WeWork occupy

37,300 sq ft, in May for £40 million

reflecting 5.00% NIY for a new 20

year lease. Investors are starting to

accept co-working covenants which,

despite as a sector accounting for

10% of London take up in 2015, have

been treated with a degree of caution

owing to a lack of clarity surrounding

operators’ financials.

Tech giant Apple has signed a deal

to take c. 500,000 sq ft of office

space at the heart of Battersea

Power Station. This represents a

commitment to 40% of the office

space within the iconic Grade II* listed

former boiler house, and will make it

one of Apple’s largest bases outside

of the US. The new Apple campus will

house around 1,400 employees from

existing sites across the capital when

it opens in 2021.

This is positive news for the

consortium of Malaysian investors

who have been driving the £8 billion

regeneration project since purchasing

the site out of receivership for £400

million in 2012. This transaction, along

with the extension of the Northern

Line to Battersea which is due to

open by 2020, should act as the

catalyst required to redefine this new

London submarket, in the same way

that Google is widely credited with

doing at King’s Cross.

Moor Place, EC2

ROUND-UP

Sam Harper,

Surveyor,

rounds up the top

news stories of the

past quarter

Co-working Covenant

Makes the Grade

Apple Plants Flag in

the Sand at Battersea

London at

a Glance

Development Aims High

All Points Covered on

the Retail Compass

Sadiq Khan has appointed US

comedian Amy Lang as London’s

‘night tsar’. She is tasked with the

protection of London’s night life

economy, which is worth £26 billion

a year, representing around eight

per cent of London’s economy and

supporting one in eight jobs. Since

her appointment in November, Amy

has already played a central role in

the high profile reopening of the

iconic Fabric nightclub in Clerkenwell,

following its closure in September.

This is being heralded as a major

win amidst the reported decline

of London’s wider cultural scene,

including the closure of 35% of

grassroots music venues since 2007.

The Mayor’s appointment of a night

tsar recognises increasing pressure

on cultural uses from higher value

alternatives such as office and

residential. It seems logical that

such intervention will go to protect

developers in the long run, as it

preserves the cultural variety that has

been integral to London’s ability to

attract the top talent and its success

as a global city.

Protecting London’s Fabric

In a post Brexit boost to London, AXA

Investment Management / Lipton

Rogers have pledged to go ahead with

the 1.4 million sq ft 22 Bishopsgate. In

the weeks before the referendum AXA

had stated that they would review the

largest development in the City if the

vote was to leave the EU. The decision

to build is a sign of confidence in the

longer term prospects for the City, and

follows on from the successful leasing

performance of Leadenhall Building

(100% let), 20 Fenchurch Street (100%

let), 100 Bishopsgate (50% prelet) let

and the Scalpel (35% prelet).

The 22 Bishopsgate design

replaced the previous Pinnacle

scheme, for which construction began

in 2008 before being suspended in

2012 due to the economic downturn.

The foundations and groundworks are

largely complete which will allow for an

accelerated construction timetable with

a completion date targeted for 2019.

CUSHMAN & WAKEFIELD

11

ROUND UP