There are also quite wide variances within London. For

example within Mayfair and the City, with micro-locations

in each sub-market showing quite large variances in

Rateable Value change.

This is reflective of the characteristics of the central

London retail market where the street address and

prominence are so significant, and turning the street

corner can see a sharp drop off in rental value.

London ratepayers suffer from the double impact of

having both large underlying rental growth, and also being

typically classified as ‘large’ (RV > £100,000) buildings,

which means that they don’t benefit from transitional relief

to the extent that smaller buildings do.

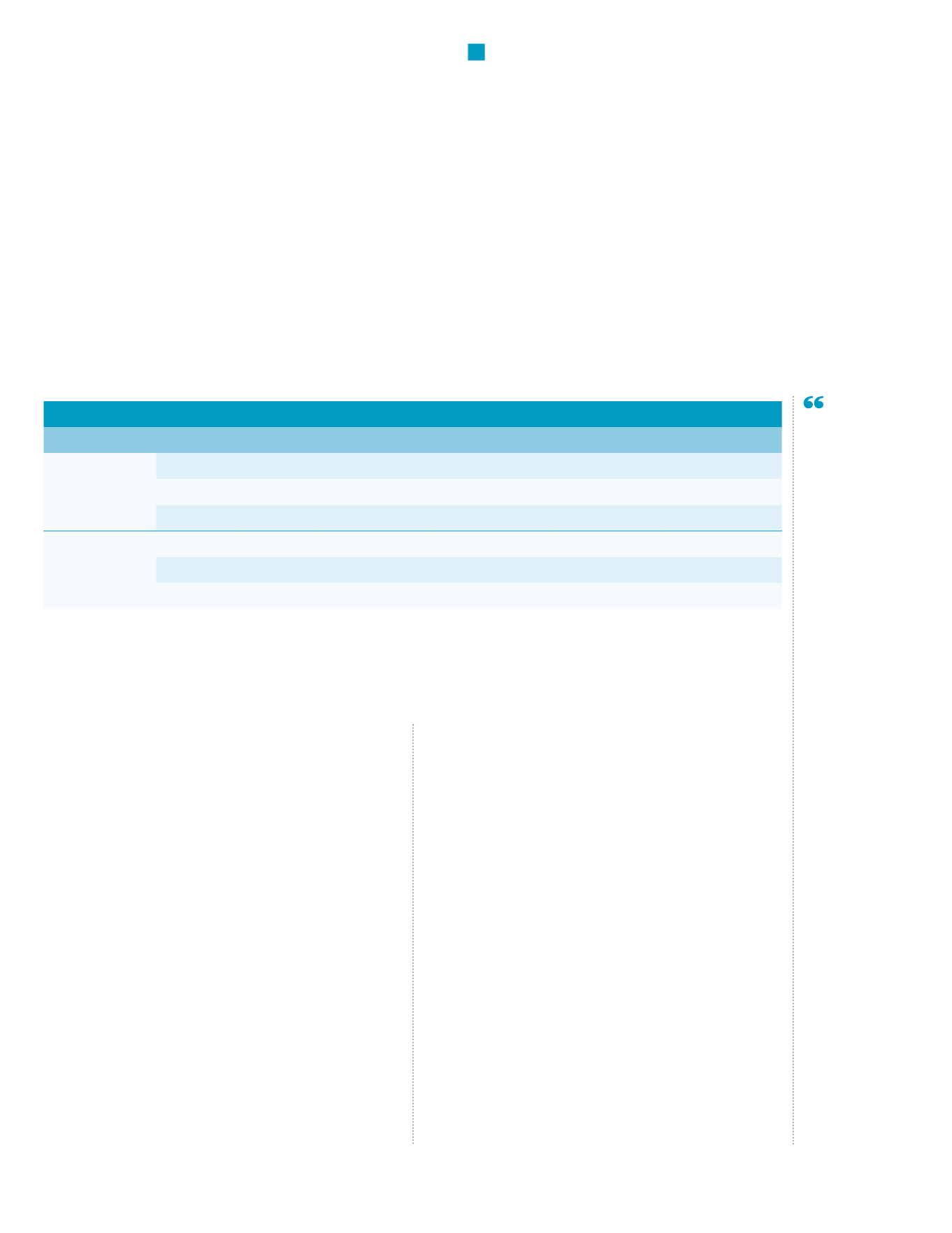

Transitional relief, tweaked slightly in the recent Autumn

Statement, is designed to taper the effect of the increase

over a few years. However, as shown in the table above,

with uplifts for large properties capped at 42% in Year 1,

and 32% in Year 2, only those with exceptional growth will

have more than two years’ worth of transitional relief.

The Uniform Business Rate (UBR) used to multiply

Rateable Values to arrive at the Business Rates payable

will be reduced next year to 47.9p in the pound (currently

49.7p), to some extent counterbalancing Rateable Value

increases. However, a third sting in the tail for London are

the supplements of 2 pence for Crossrail and 0.5 pence in

the City of London for the special security measures, both

of which are added to the UBR as appropriate and are not

limited by transition.

Impacts

will be most

notably felt

in boom and

regen areas

Whilst overall average rates changes in some areas can

appear modest, these averages do hide some real shocks,

and ratepayers will be keen to contest assessments

after the 1st April 2017. However the Government is also

introducing a new system known as Check Challenge

Appeal (CAA), which is a more complicated and costly

process, that the Government, by its own admission, have

introduced to reduce the number of appeals. Of most

concern, is the fact that in the Draft Regulations for CCA,

the Government is proposing to “blunt” the judicial powers

of the Valuation Tribunal (VT). The proposals will only

allow the VT to make a decision to alter an entry in the

Rating List if they are satisfied that the Valuation Officer

has acted outside the realms of reasonable professional

judgement, and whilst this has not been defined, it could

be interpreted as being +/- 10% or even more.

This could mean, for the largest rating assessments

in central London, ratepayers could be paying several

million pounds more in rates over the five year period

of the Rating List than is justifiable. This would make

business rates unique as a tax where the taxpayer could

be overtaxed by 10% or more with no ability to have the

assessment changed.

We await with interest the actual operation of CCA

in practice.

FINAL: TRANSITIONAL ARRANGEMENTS 2017 REVALUATION (BEFORE INFLATION) FUNDED BY 3 CAPS ON REDUCTIONS

Property Size

2017/18

2018/19

2019/20

2020/21

2021/22

Upwards Cap

Small

5.0%

7.5%

10.0%

15.0%

15.0%

Medium

12.5%

17.5%

20.0%

25.0%

25.0%

Large

42.0%

32.0%

49.0%

16.0%

6.0%

Downwards Cap

69%

20.0%

30.0%

35.0%

55.0%

55.0%

61%

10.0%

15.0%

20.0%

25.0%

25.0%

29%

4.1%

4.6%

5.9%

5.8%

4.8%

Note: these are year on year caps on increases. For instance, the maximum increase for small properties over 5 years would be 64%.

But a small property with an increase of 7% would reach their full bill in year 2. Medium is above £28,000 rateable value in London

and £20,000 elsewhere. Large above £100,000.

CUSHMAN & WAKEFIELD

13

SPOTLIGHT ON...