London, Tourismand Sharing Economy

The

partnership

with the

corporate

travel portal

Concur will

allow users

to compare

Airbnb

properties

directly with

hotels

D

espite limited supply growth in

Europe over the last decade,

London hotel supply shows no

signs of abating, with the capital

now home to over 1,600 hotels and

149,200 bedrooms. In 2016 alone,

53 new hotels opened, including 15

aparthotels and 16 budget hotels. This

trend is continuing through 2017, with

59 new hotels, providing 3,575 new

rooms, expected to be added to the

stock by the end of the year.

However, this isn’t the whole

picture. There is a new market

developing around the sharing

economy that is growing at a quicker

rate and this may be only the tip of

the iceberg. The number of properties

listed on Airbnb almost doubled over

the course of 2016 to 50,000 and

bookings surged by 130% in 2016 (to

4.6M) and by a further 55% during

the first four months of 2017. As a

result, Airbnb’s share of the London

overnight stay market has more than

tripled since January 2015 to 9%.

Whilst these stats may illustrate

the capacity for expansion in both

With over 19 million visitors to London every year, our capital

remains one of the world’s most important markets for hotel

operators. Success attracts competition and competition breeds

innovation. We are already seeing this in the market, but on the

horizon there are potentially bigger changes.

TOURISM

By Jeanne De

L’Espée,

Senior

Consultant,

Hospitality

and Maria-Pia

Intini,

Director,

Development &

Investment,

citizenM

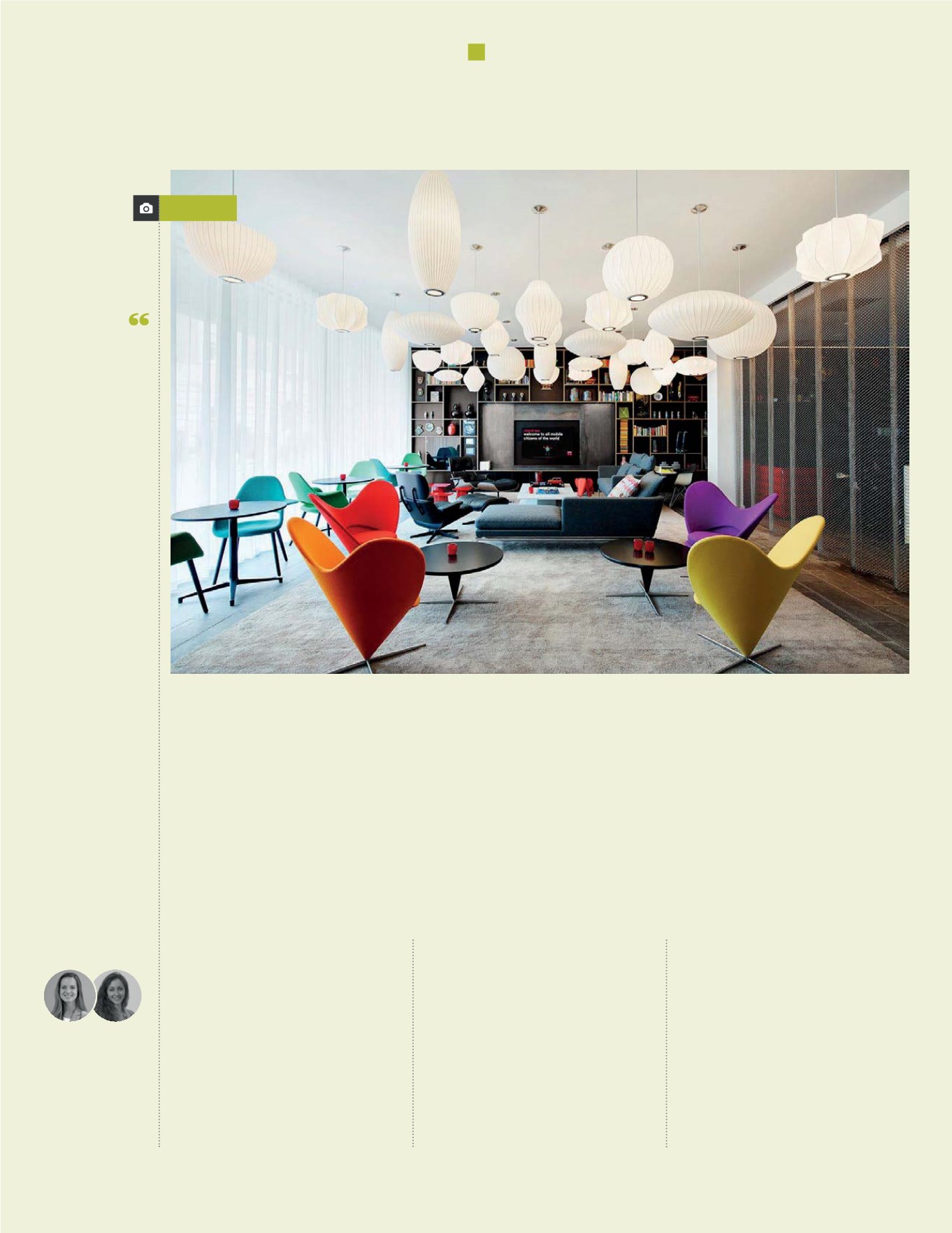

citizenM Tower of London

markets, one only has to look at the

retail sector or the taxi industry to see

how digital platforms can quickly take

share from incumbents. As the private

market develops a taste for using the

platform, unless there is intervention

from regulators, inventory levels will

rise and hoteliers will face challenges

to sustain existing growth trajectories.

But more than that, the emergence

of the so-called sharing economy

has already started to alter consumer

expectations on a fundamental level

and redefine what and where a hotel is.

CUSHMAN & WAKEFIELD

17

TOURISM