W

ith lot sizes over £1 billion this provokes the

question as to what is driving these buyers.

The answer depends on where in the world you sit.

Sterling has weakened significantly since Brexit so

from a currency point of view prices are cheaper on the

exchange rate basis.

On a global basis, yields for similar prime CBD office

properties, whether it be Tokyo, Taipei, Amsterdam or

Berlin, are all beginning with a 3% yield.

In this context, new best in class assets with income

streams in excess of 10 years, let to a range of investment

grade covenants can attract excellent leverage thereby

providing enhanced geared returns.

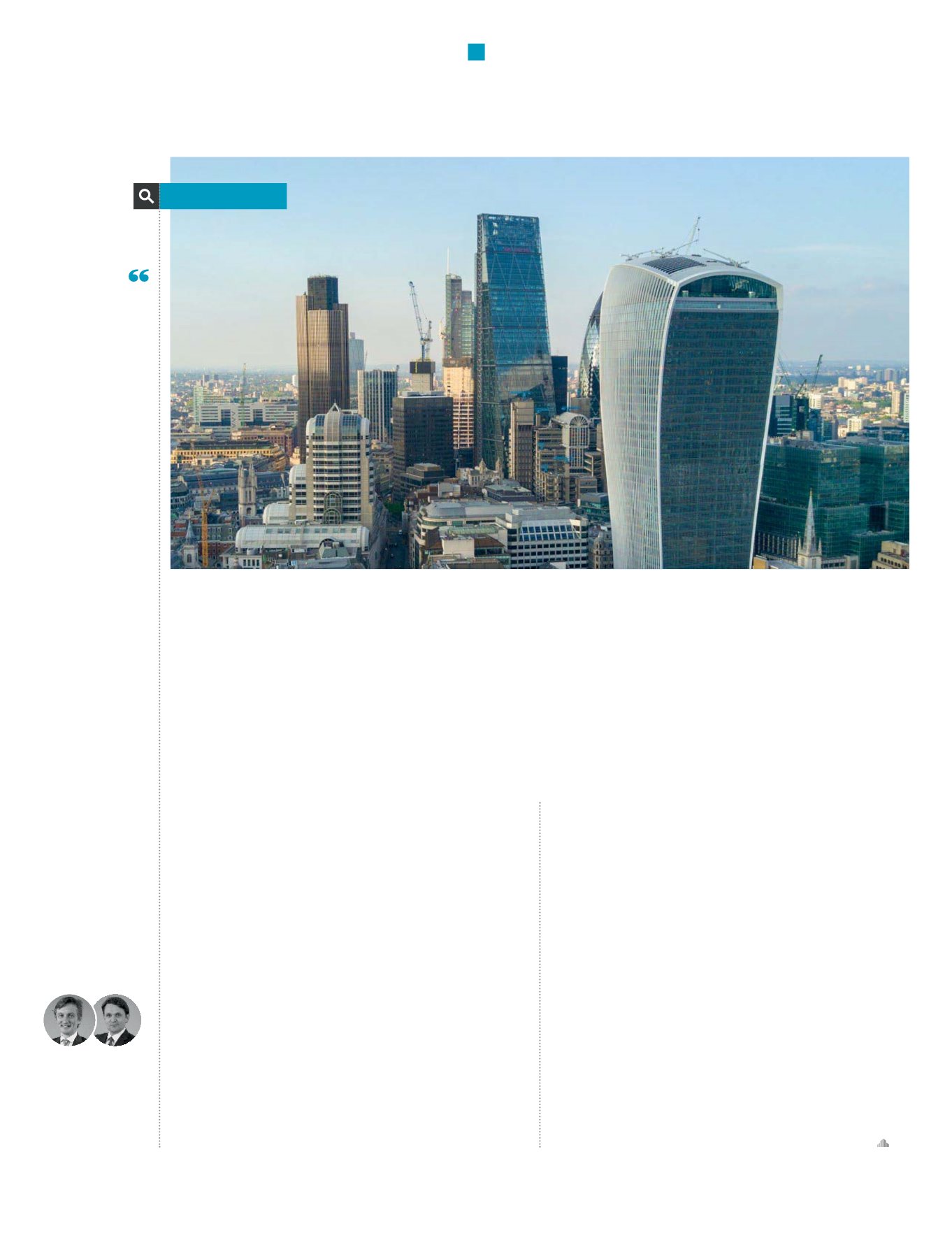

With both the Cheesegrater and the Walkie Talkie the

buyers are Ultra High Net Worth investors from Hong

Kong, being CC Land and LKK respectively. Given the

increasingly assertive regime from mainland China, there

is a push for global diversification and London is of course

a first point of call being a global gateway city with rule of

law, transparency, accessibility and liquidity.

Whilst many Brits see Brexit as disruptive and negative,

depending where you sit in the world it could easily just

be seen as a part of the democratic process, which is a

privilege not enjoyed by many jurisdictions.

Following the statement made by the Chinese State

Council restricting investments in sectors including

gambling and real estate (no connections assumed!) this

raises the question as to whether the Chinese investors will

be pulling back. Interestingly as Dalian Wanda pulled out

of completing on their Nine Elms scheme it was CC Land

that stepped up to take their place.

The context here is important with the US having had

$16.4 billion of Chinese investment in 2016 and $7.2 billion

this year, the UK has had $1.8 billion in 2016 and $6.5 billion

this year.

Apart from the recent acquisition by CR Land at 20

Gresham Street where we sold for AXA at £310 million,

there haven’t been that many Central London purchases by

state-owned enterprises. The four big highlighted entities

from China, An Bang, Fosun, H&A and Dalian Wanda,

haven’t had a deep impact on the London market.

It is the Ultra High Net Worth families out of Hong Kong

and Singapore that are making the running at the moment.

Our experience of acting on these two leading tower

investments, has given us a unique insight into this market,

and we expect the trend to continue looking forward.

The Two Towers

By Martin Lay,

Co-Head of London

Capital Markets

and Argie Taylor,

Partner, Cross

Border Capital

Markets

It is the

Ultra High

Net Worth

families out

of Hong Kong

and Singapore

that are

making the

running at the

moment

The pricing for City office towers has been reset by the transactions

at The Leadenhall Building and 20 Fenchurch Street. The Cheesegrater

and Walkie Talkie respectively have seen yields for new iconic office

towers in London driven down to sub-3.5%.

SPOTLIGHT ON...

CUSHMAN & WAKEFIELD

13

SPOTLIGHT ON...