As well as

impacting

mainstream

hotels, Airbnb

and other

intermediaries

have also

become a

disruptor

to the wider

residential

market

This impact of Airbnb is also

diversifying across market segments.

Alongside leisure travellers (upsold

with tours and excursions by ‘Airbnb

Trips’), Airbnb is now also directly

targeting the business and the luxury

travel markets. The partnership with

the corporate travel portal Concur

will allow users to compare Airbnb

properties directly with hotels. The

pilot project, unofficially referred to as

‘Select’, will allow Airbnb to address

older and wealthier travellers still

preferring the amenities that come

with upscale and luxury hotels.

Traditional operators cannot

ignore the disruption and many

are taking stock of their positions.

As a result of a cited ‘material

change’ in their circumstances, hotel

operators, supported by the British

Hospitality Association, are likely to

appeal against the higher business

rates proposed in the April 2017

revaluation. In some cases rates

payable will more than double. The

argument for material change has

greatest weight in Westminster, Tower

Hamlets, Kensington & Chelsea and

Hackney, which collectively account

for almost 50% of all Airbnb bookings

in the UK in 2016.

Lack of regulation is becoming

an increasing concern not only for

hoteliers but also for local authorities

and many private landlords,

although things are starting to

change. From early 2017, Airbnb’s

systems automatically limit entire

home listings in Greater London to

90 nights per calendar year unless

users submit an Exemption Form to

share their space more frequently.

However, the 90-day limit is difficult

to police and the associated tax

advantages deliver around one third

of the savings that Airbnb offers

to its customers. This is without

even considering the alternative

home-sharing platforms. In addition,

inspections to check hotel-standard

fire protections are far less common

than for traditional B&Bs and hotels.

As well as impacting mainstream

hotels, Airbnb and other

intermediaries have also become a

disruptor to the wider residential

market. Last March, Sadiq Khan

warned that the rise of short-term

rentals risks reducing the number

of homes available for permanent

residents, albeit demand in the long-

let market has softened since Brexit.

This, together with the recent cuts

in tax breaks on mortgage-interest

payments and the growing pressure

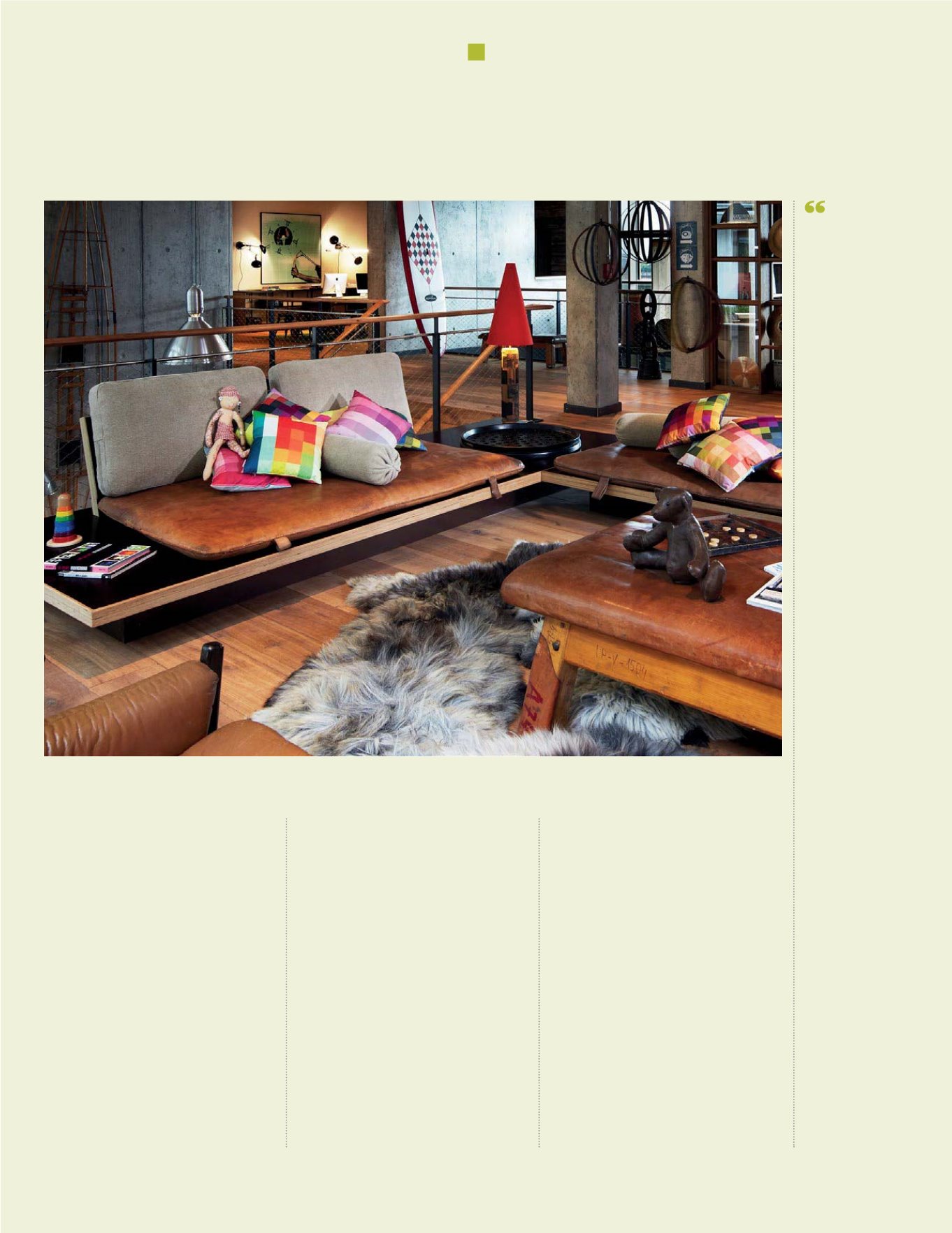

25Hours Hotel Hamburg

CUSHMAN & WAKEFIELD

18

TOURISM