However, his point is bigger than technology driving

change. He questions the inherent structure of the real

estate business model, and points a finger at those who fail

to add value for their customers. The real estate sector has

been largely defended by factors such as location, visibility,

accessibility, customer switching costs, access to information,

access to capital and regulatory inhibitors to competition.

These shields are being beaten away by societal and

disruptive trends, leaving incumbents now needing to

focus harder on how they serve their customers.

In particular, he asks us to look at where there are

deficiencies in our value chain, and highlights these as

opportunities for new players to not only create space,

but to capture the majority of the profit pool. A large

share of residential real estate is gradually becoming a

commodity in the modern world. Beyond location, most

of our buildings conform to similar specifications, which

are adequate, safe, and functional. In these conditions,

Leaving

traditional

property

landlords as

commoditised

suppliers

The warning is

a stark one; be

bold and or be

disrupted

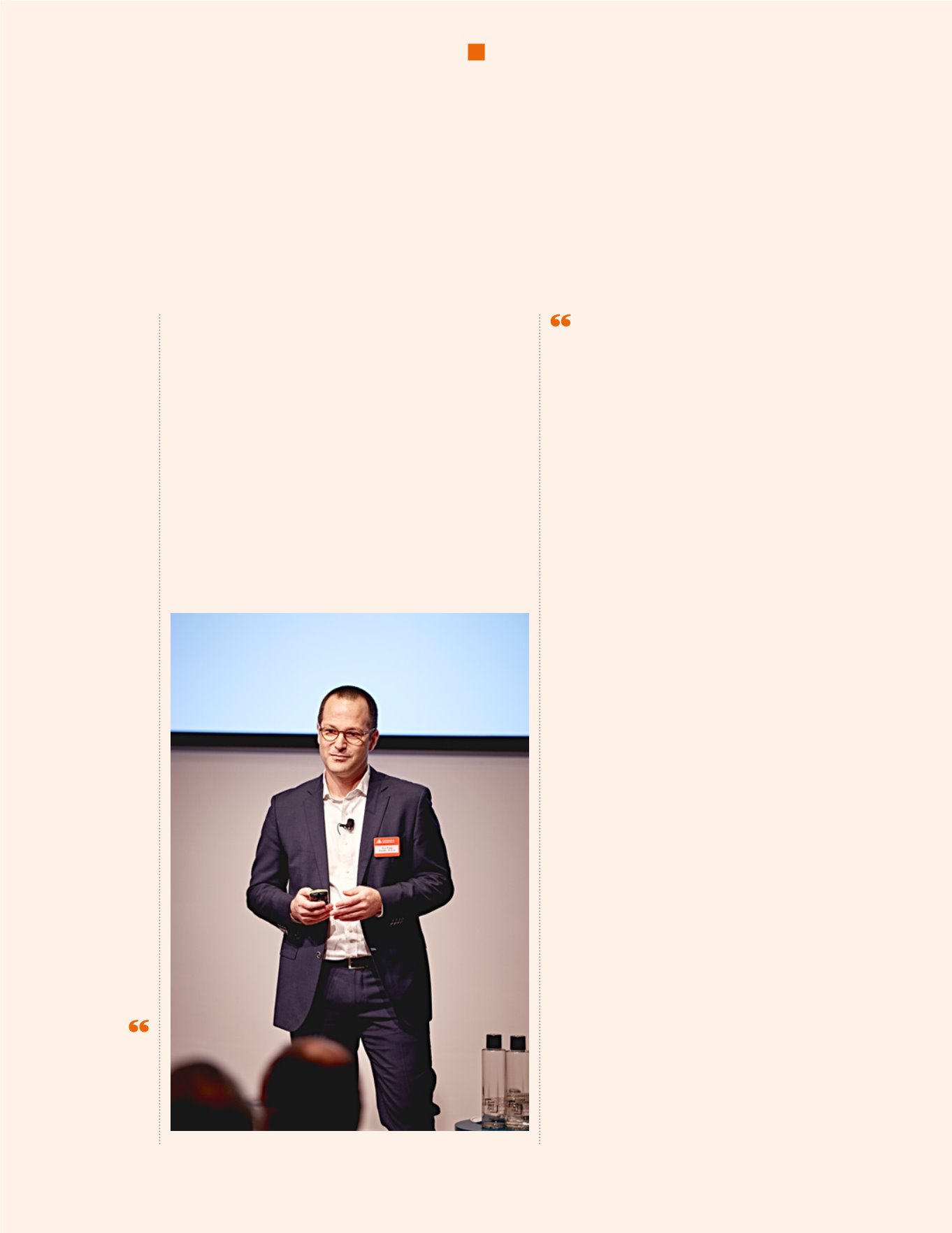

Dror Poleg at The Future of Living

there is greater opportunity downstream of bricks and

mortar to capture the market by providing end-consumers

the differentiated product that they seek. In this way, the

Ubers and WeWorks of the world transition from being

intermediaries into being principals, leaving traditional

property landlords as commoditised suppliers.

The points of differentiation vary by market; however, Dror

points to a couple. Firstly, providing a frictionless consumer

experience is essential in a world of increased convenience.

Why, he asks, as a tenant would you go through the pain

of securing a traditional letting, with complex procedures,

unknown landlords, and longer commitments, when you

can spend two minutes on AirBnB and be done. The former

would in this context be ‘unsufferable’.

Secondly, the mass market is not tailoring its products

to consumer needs. He believes that developers have a

propensity to overspecify their product. Historically, higher

margins have been available at higher price points for less

effort, which is what has driven this approach. However,

in stretched housing markets such as London and New

York, there is now opportunity to be found at lower price

points, which are susceptible to low level disruption.

By unbundling elements of the traditional home, better

(more segment-specific) solutions can be provided to the

consumer. For instance, the kitchen was once an essential

part of the urban home. However, with changing lifestyles

and increasing unaffordability, it becomes an optional

extra, where there is a legitimate trade-off between

having a shared kitchen and paying a higher rent.

As a whole the presentation asks some searching

questions of the property industry, and the points

made about residential are equally applicable to other

sectors. The underlying call to action is to evaluate your

environment, spot poor performance and react before

others do. For many established property owners, which

are less nimble and operate with higher cost bases, it may

be challenging to move vertically within their value chain.

However, the warning is a stark one; be bold and or be

disrupted. Or as another Dickens’ character put it:

‘A man

can well afford to be as bold as brass, my good fellow,

when he gets gold in exchange!’

14

FUTURE OF LIVING